Everyone’s got their own experience and opinion on the impact of COVID on recruitment, particularly for different industries. But what do the stats say?

We dug into our job application volume data* for every month throughout 2019 and 2020. To see what changed and how.

*(You’ll see we haven’t cross-referenced these against the number of roles advertised, so a spike in application volume could reflect an increase in live roles (or not). It’s the 2020 to 2019 comparison you’re looking at most).

Here’s what we found.

The highlights reel

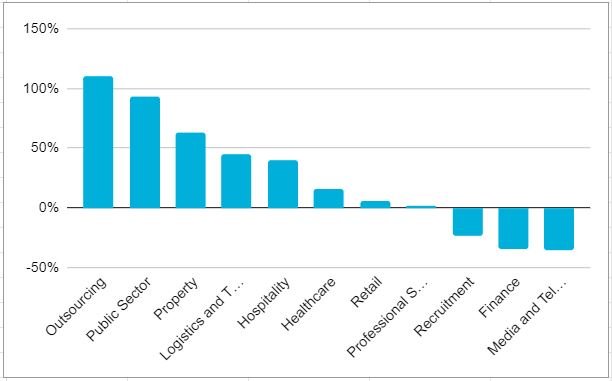

Here’s how 2020 compared to 2019 in overall annual application volume for various sectors:

- Outsourcing – 110% more applications in 2020

- Public Sector – 93% more applications in 2020

- Property – 63% more job applications in 2020

- Logistics and Transport – 45% more applications in 2020.

- Hospitality – 40% more applications in 2020

- Media and Telecoms – 36% fewer applications in 2020

- Healthcare – 16% more applications in 2020

- Retail – 6% more applications in 2020

- Professional Services – 2% more applications in 2020

- Recruitment – 24% fewer applications in 2020

- Finance – 35% fewer applications in 2020

Those headline figures hide much month-on-month variation though.

For example, December 2020 saw the healthcare sector battling with 280% more applications than the same month in 2019. Or the retail sector saw 220% fewer applications in May 2020 compared to October 2020.

And April saw a drop-off in application volume within every industry (sometimes HUGE), thanks to COVID.

Although on the other hand, we heard from some clients that March, April and May were their busiest months, thanks to the COVID fall-out, staff absences, work-from-home and new demand. Even when application volumes were low, COVID created a lot of turbulence for recruiters, it seems…

Skip to your sector below to dig into trends more deeply.

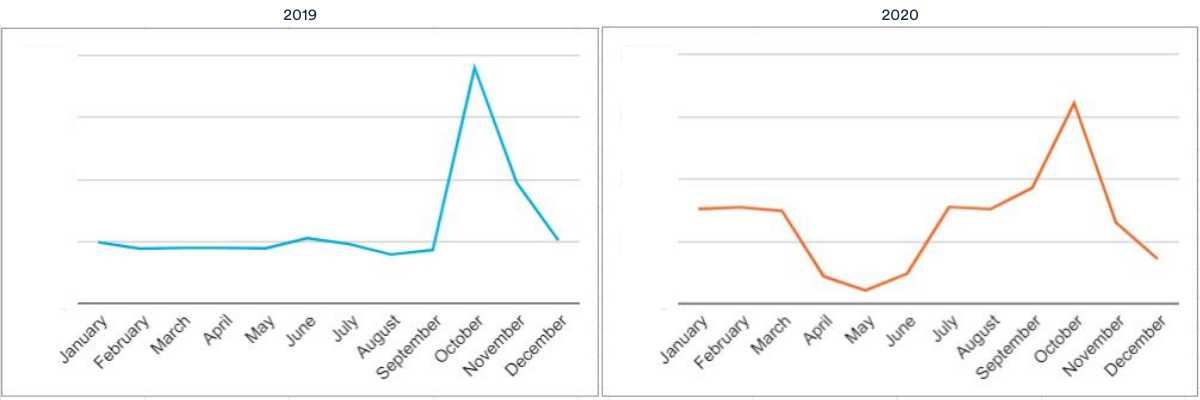

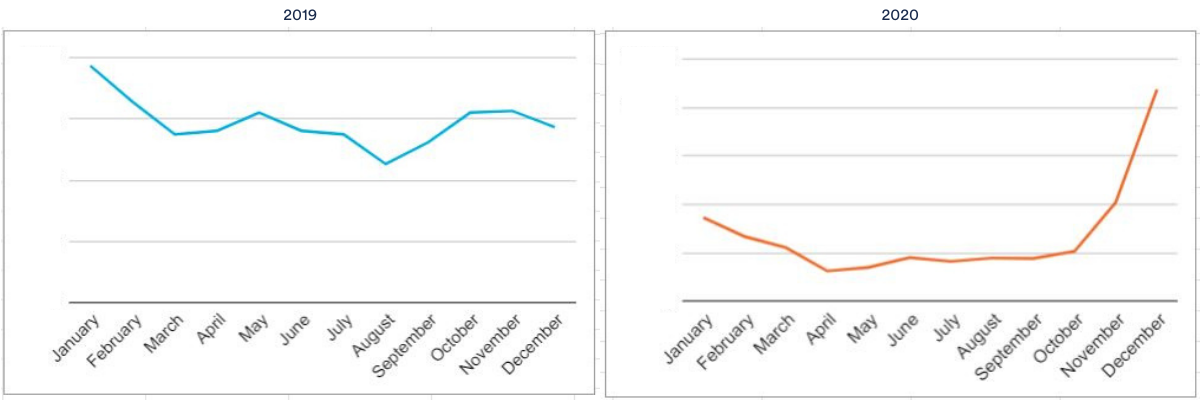

How did COVID impact retail recruitment in 2020?

In 2019, the retail sector saw roughly steady application volume from January until September. Then October and November saw a sudden increase, as retailers prepared for the busy Christmas period, before returning to average in December.

Our data revealed much the same trend at the start of 2020 – but with a sudden dip when COVID started picking up pace, during April, May and June. From June to July 2020, application volume leapt up by 220% – then rose fairly steadily to an October high. COVID madness combined with Christmas madness.

October was the busiest month for retail recruiters in 2020, and May was the quietest. There was a 1400% difference in application volume between the two. Those peaks and troughs roughly levelled off overall though, as 2020 only saw 6% more applications than 2019.

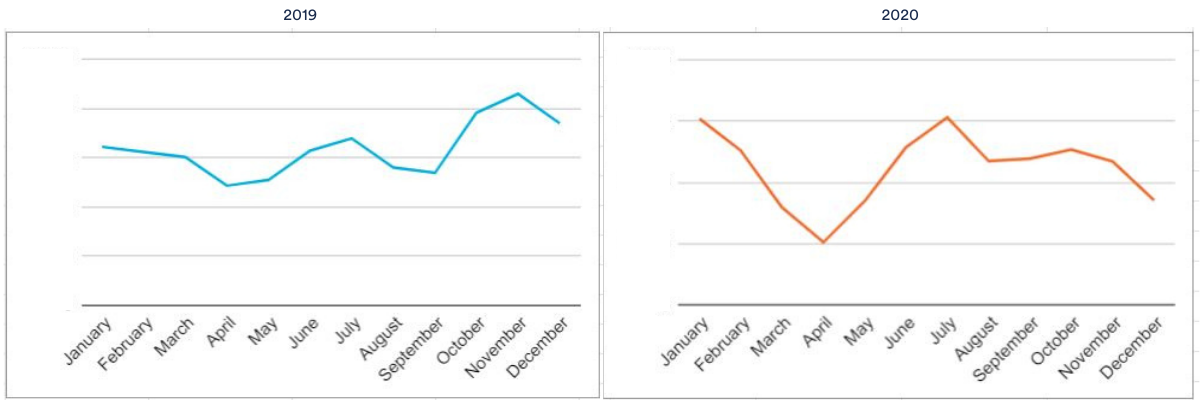

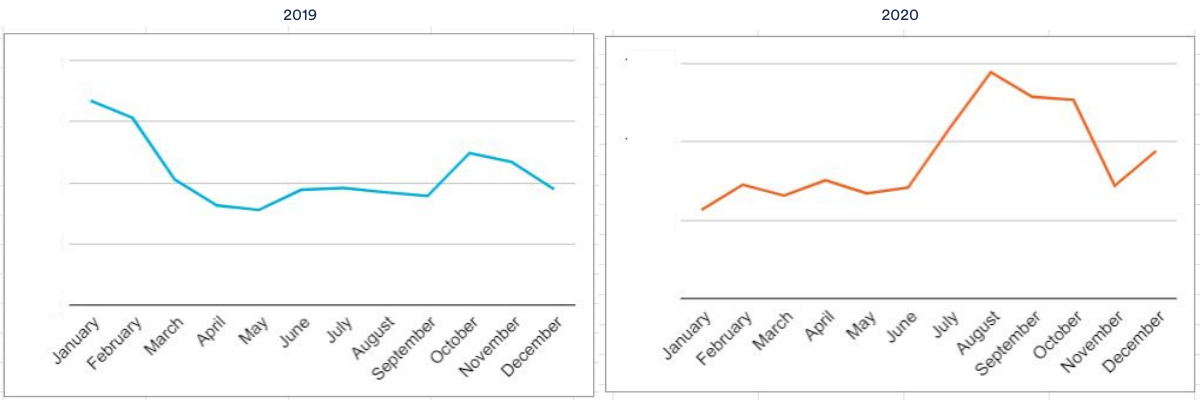

How did COVID impact hospitality recruitment in 2020?

In 2019, the hospitality sector saw almost totally consistent application volume month-on-month, with a slight spike over the summer and the Christmas period. January 2019 also saw a bump – the new year, new job phenomenon we’ve tended to see in most industries.

January 2020 echoed that trend, actually proving the busiest month for hospitality recruiters overall. Then COVID happened and application volume took a nose-dive until an April low (66% lower than January 2020).

Testament both to a lack of new opportunities and job applicants staying put in face of uncertainty, most likely.

After April, hospitality job applications ramped back up. July nearly hit January’s high point, and application volume stayed high until December 2020. This will’ve left many hospitality recruiters facing a quantity/quality dilemma.

(Read more: How to use rec-tech to manage soaring application volumes)

Overall, hospitality saw 40% more job applications in 2020 than 2019.

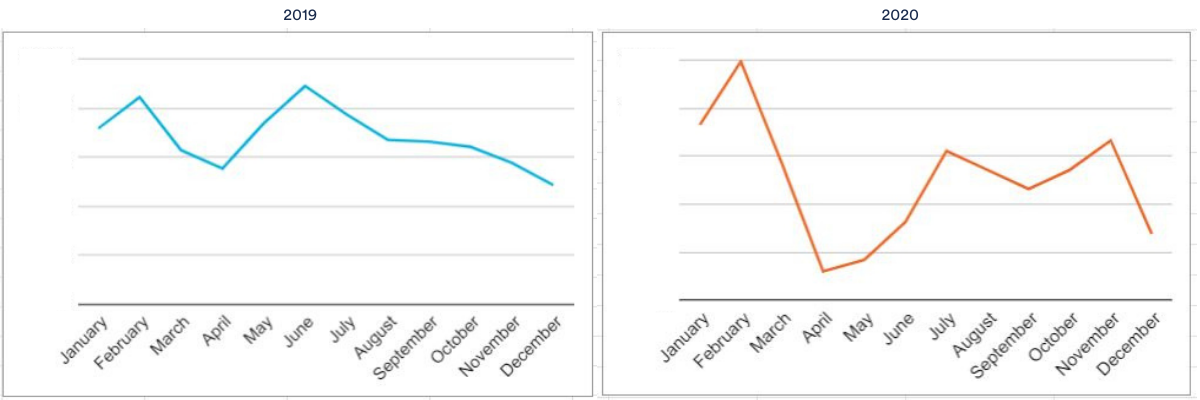

How did COVID impact media and telecoms recruitment in 2020?

In 2019, the media and telecoms sector was busiest during February and June – seeing 19% and 23% more applications than the annual average respectively. The sector saw least applications in April and December, 23% and 40% less than the annual average.

Early 2020 started off sticking to the same trend, with peak application volume happening in February. In February 2020, job applications exceeded 2019’s annual average by 45%.

But then, COVID. And as we’re seeing across the board, applications dropped right off by April. April was also one of the quietest months for media and telecoms in 2019 but there were 78% fewer applications in April 2020 compared to the same time the year before.

Application volume started to bounce back pretty fast though, increasing five-fold from April to July (although July 2020 still saw 25% fewer applications than July 2019).

Recruiters who dedicated time to building and nurturing talent pools during these quieter months are almost certainly the best prepared for 2021.

As of December 2020, though, media and telecoms’ job applications were still 60% lower than 2019’s annual average. Overall, media and telecoms’ saw 36% fewer applications in 2020 compared to 2019.

How did COVID impact healthcare recruitment in 2020?

In 2019, the care sector saw fairly consistent application volume month-on-month. January 2019 was the busiest month – 31% more applications than the annual average – and August was quietest – with 23% fewer.

The first quarter of 2020 stuck to the same trend of general consistency – although Q1 2020 application volume was 18% higher than the 2019 average. Then, as in every sector, April and May 2020 saw lower activity than usual.

April and May 2020 were the only two months that saw dramatically fewer applications than the 2019 annual average though. And by November and December 2020, application volume increased massively.

With application volumes hitting 270% more than 2019’s annual average, December 2020 will have seen many overwhelmed health and social care recruiters! As ever, smart tactics to manage application volume will’ve proved critical.

Overall, healthcare saw 16% more applications on average across 2020 compared to 2019.

How did COVID impact outsourcing recruitment in 2020?

In 2019, the outsourcing sector started busy – the busiest months for application volume were January and February – then got quieter. Applications stayed roughly steady from March throughout the rest of the year, with a slight bump in October and November.

By 2020, the data spread starts looking completely different. The year started quietly – January was the quietest month – but then picked up dramatically from June through November.

July, August, September and October saw roughly double the applications than some other months. January 2020 saw 61% fewer applications than August’s peak, for example.

Overall, 2020 saw 110% more applications than 2019.

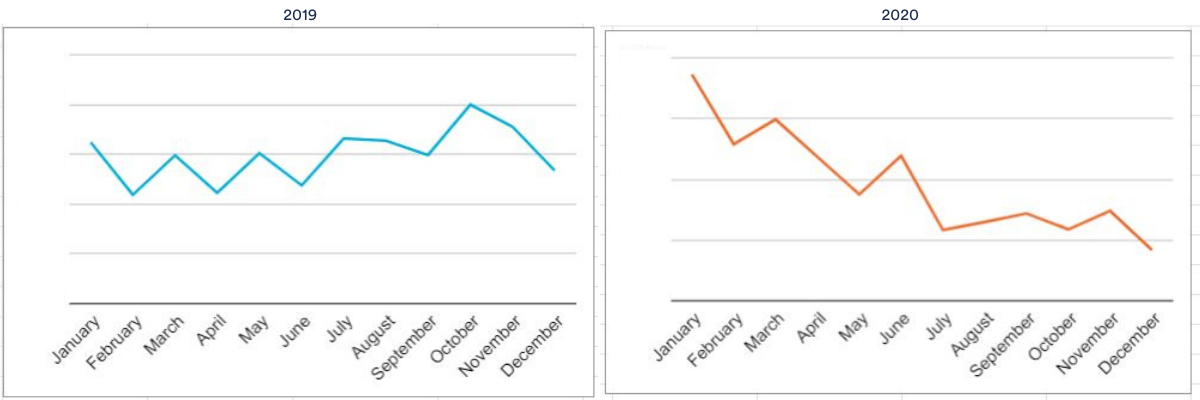

How did COVID impact financial sector recruitment in 2020?

Both 2019 and 2020 saw large peaks and troughs in application volume for finance, which often proves difficult for recruiters to manage.

In 2019 though those peaks and troughs deviated from a fairly flat baseline, without a major upwards or downwards trend from January to December. In contrast, 2020 saw a sharp downwards trend throughout the year, with the fewest applications in December and the most in January (a 77% difference).

Overall, the financial sector saw 35% fewer applications in 2020 compared to 2019.

How did COVID impact public sector recruitment in 2020?

In 2019, the public sector received the most applications during June, October and November. February and March were the quietest months, with 32% and 39% fewer applications than the annual average.

Overall, 2020 saw higher application volumes than 2019 in almost every month, aside from a major dip in April. November, October and July were the busiest months of 2020 – November saw nearly 200% more applications than 2019’s annual average.

On average, public sector recruiters received 93% more applications in 2020 compared to 2019.

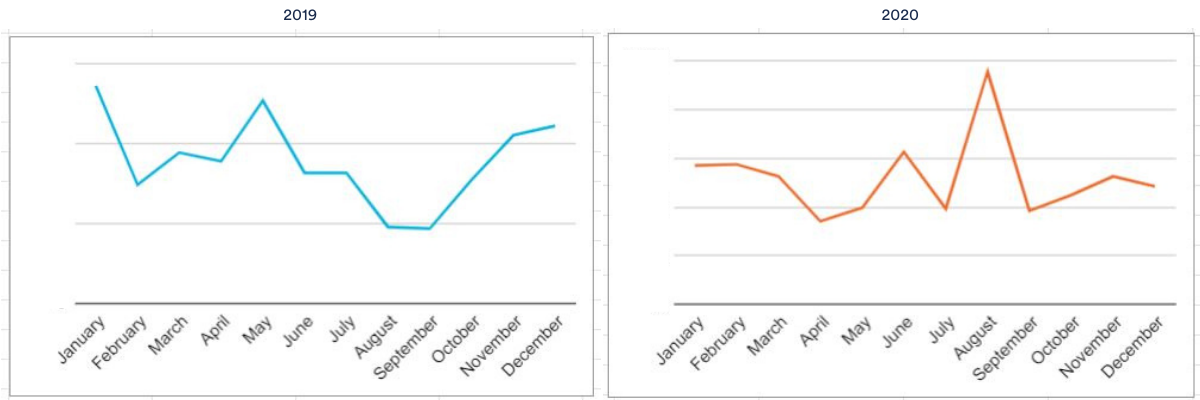

How did COVID impact logistics and transport recruitment in 2020?

In 2019, logistics and transport application volume was patchy. The most job applications happened in January, May, November and December – the year’s peak happening early on, in January.

By 2020, application volumes across the board increased, apart from the same April nosedive we’re seeing elsewhere. August was an especially busy month, with 398% more applications in August 2020 compared to August 2019.

Overall, logistics and trade saw 45% more applications in 2020.

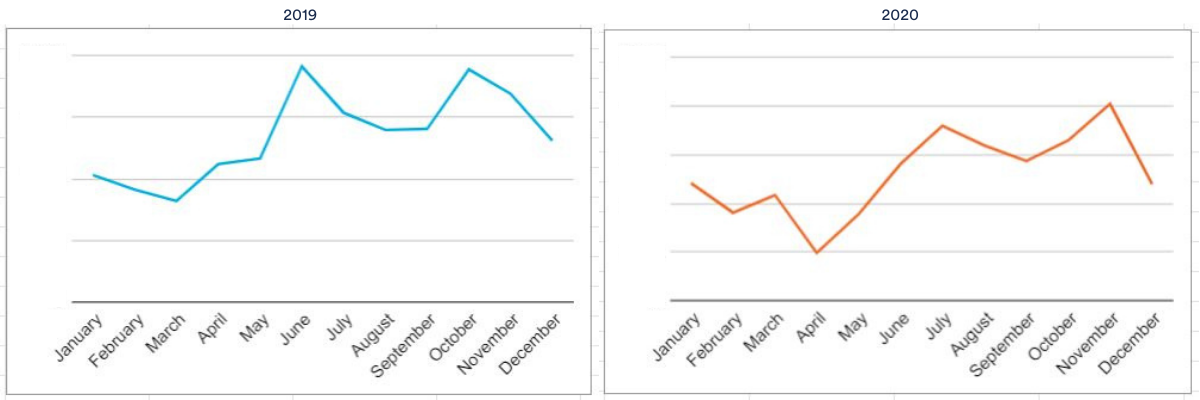

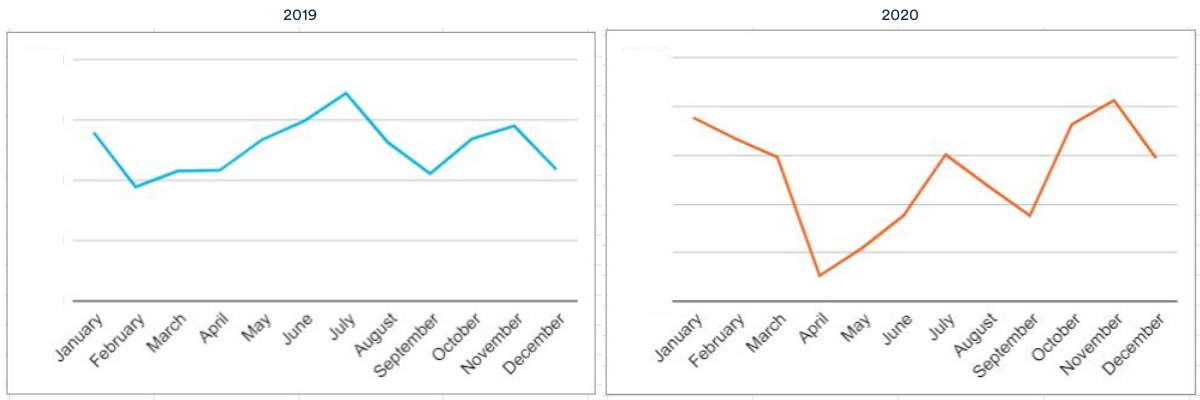

How did COVID impact professional services recruitment in 2020?

In 2019, the professional services sector saw the most job applications in January, July and November. July – the highest – saw 35% more than the annual average. The quietest months were February and September – both showing an almost immediate dip after busy preceding months.

2020 also saw much month-on-month variation, although with similar patterns to 2019. The year started with high application volumes in Q1 – Q1 2020 saw an average 47% more applications than Q1 2019 – but dipped dramatically in April and May.

By Q4, application volumes had returned to Q1 highs – and November 2020 was the busiest month of the year.

Overall volumes mostly levelled out though, with only 2% more applications in 2020 to 2019.

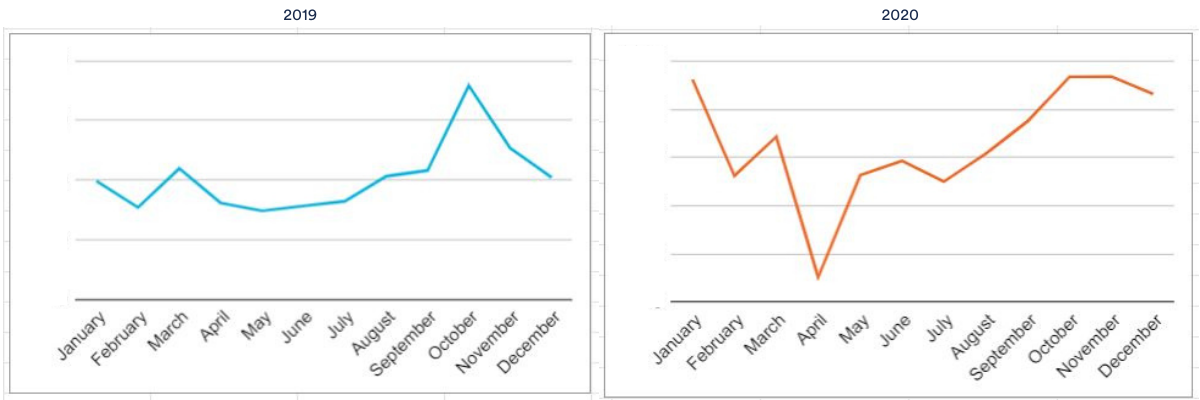

How did COVID impact property recruitment in 2020?

In 2019, the property sector enjoyed mostly steady application volume in Q1 to Q3, before an increase in Q4. The busiest month was October, with 76% more applications than the annual average.

February was particularly quiet, with 24% fewer applications than the annual average. Q2 as a whole was quiet too.

Following a busy end to 2019, property recruitment got off to a great start in 2020: January was one of the busiest months of the whole year. Application volume stalled almost completely in April though, dropping from 89% from January.

The sector was quick to bounce back though, and by May application volumes continued to climb steadily for the rest of the year. Like 2019, 2020 was busiest during Q4.

Overall, the property sector saw 63% more job applications in 2020.

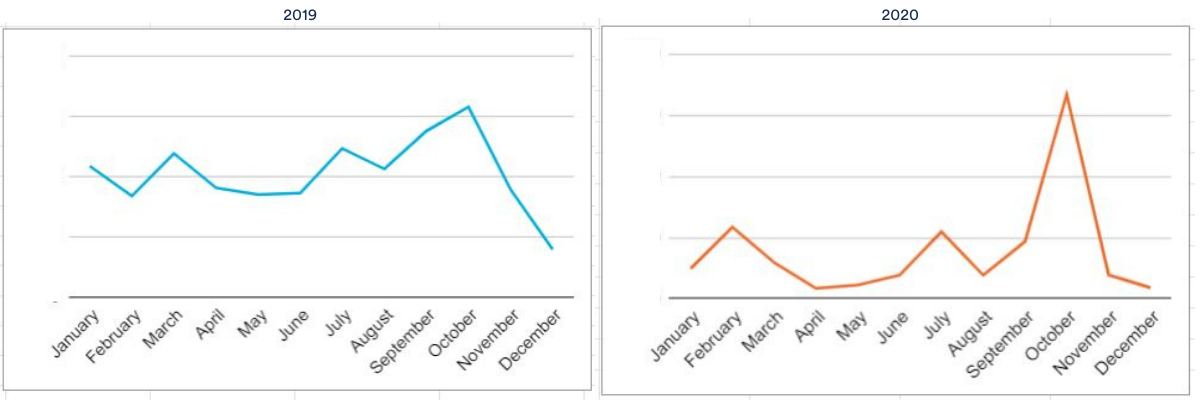

How did COVID impact recruiter recruitment in 2020?

We couldn’t forget the rec-to-rec sector, of course.

2019 saw little variation from month-to-month besides a major drop-off at Christmas – December was the quietest month by a long chalk. But we all know 2020’s been a tumultuous year for most recruiters, and our data bears that out.

Q1 2020 started fairly steadily, but application volume then dropped off dramatically in April and didn’t pick back up until a spike in July. The next huge spike came in October 2020, which saw nearly 2000% more applications than April 2020. That’s also 111% more applications than October 2019.

Overall though the recruitment sector saw 24% fewer applications in 2020 – perhaps testament to recruitment riding out the COVID storm better than many other industries.

As you’d expect, no industry was unaffected by COVID. But there’s encouraging evidence of many industries starting to bounce back, with increasing job application volume testifying both to an increase in open roles and an increase in candidates.

Given the past several years – with most recruiters battling a fiercely candidate-driven market, this could be a big positive. Especially for teams’ leveraging recruitment technology smartly, so higher application volumes don’t add complexity and decrease quality.

…Does your experience mirror our stats? What’s been your experience of recruitment in 2020? Drop us a comment below

Tribepad’s talent acquisition suite helps recruitment teams improve recruitment delivery, whatever challenges you face throughout the year. You’ll especially love our powerful recruitment analytics, helping you learn from your own data to make huge leaps forwards. Find out more.