You’ve just been charged with researching potential recruitment software for the team. Exciting! But now the pressure’s on. You’re wondering…

- Where should you start?

- What’s your boss actually expecting?

- How can you meet the whole team’s needs?

- How much detail should you include?

- How can you go above and beyond?

In this practical toolkit, those are the questions we’re answering. We’ll give you a step-by-step roadmap to researching recruitment software and presenting your findings in a comprehensive, balanced and clear way.

Let’s go.

This is part of our Practical Toolkit for Recruiters series. If you haven’t already, check out our practical toolkit for copywriting, and practical toolkit for recruitment marketing. And whiz us an email anytime if there’s anything you’d love to see in the series.

Step 1: Write your shopping list

Being asked to research recruitment software rarely comes as a surprise. It’s probably the result of weeks (maybe months!) of butting up against the limitations of your current set-up, so you’ll already have a good general idea what the team needs.

But now’s the time to distil that general idea into a specific shopping list. From ‘we want to start video interviewing candidates’ to ‘we want video interviewing software that ticks boxes A, B and C’.

Talk to your manager

If they haven’t already clarified, ask your manager about budget, timeframe and any relevant business context.

Like, perhaps the company approached Provider A last year but IT wasn’t happy with their security. Or increasing diversity is a major business priority, so you’ll want to look for an ATS that’ll support that goal. And maybe set-up for your new HCM system was a total nightmare so the team’s hyper-sensitive to data migration issues.

Talk to IT

IT is a crucial decision-maker when you’re buying software, even if they won’t actually need to do much. They’ll typically care most about stuff like data security and compliance, compatibility with your existing systems and reliability. How easy is the software to implement and use? What about future integrations, when the business adds new tools?

You can save yourself a heap of time – and make your manager’s life easier when building a business case – by chatting to IT upfront and asking what their criteria are, so you can prove the software you choose will alleviate – not cause – headaches.

Talk to your team

Get everyone in a room together to brainstorm:

- What’s the problem new recruitment software needs to solve?

- What are our biggest pain points in the recruitment process?

- What are we really trying to achieve? What does success look like?

- What are your must-haves? Nice-to-haves?

Distil your notes into a one-page priority list and circulate amongst the team to get their buy-in early. Then get your manager’s sign-off too. You don’t want to spend ages researching recruitment software you think does what the team needs, only to be sent back to the drawing board.

Step 2: Create an evaluation matrix

Now you need to turn your shopping list into something you can use to evaluate recruitment software providers. You’re giving yourself the tools to be as objective as possible. A robust process justifies your decisions later.

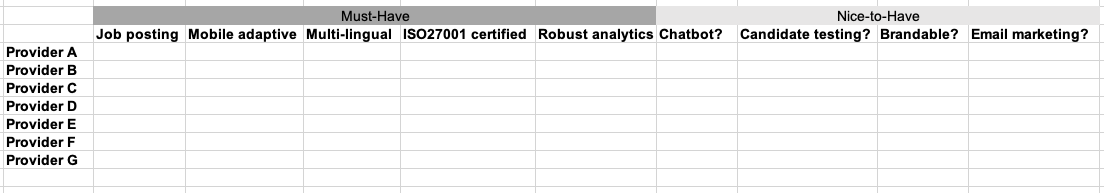

So your scoresheet for an ATS might look something like:

Product fit should come first. It’s easy to be swayed by great salespeople, but creating an evaluation matrix means you make decisions based on what your team really needs.

Step 3: Research your longlist

Now the research starts! Here are some possible hunting grounds.

Search engines

Write everything down for the first handful of pages. PPC (ads at the top of the search results) can be a helpful indicator but don’t weigh them too heavily.

Businesses appearing top aren’t necessarily the biggest or the best; they’re spending the most on PPC. Likewise, businesses who’re the best at SEO mightn’t be the best recruitment software providers.

At this point, don’t rule anyone out. This stage is about building awareness of who’s out there – not making judgements.

Your past experience

It’s often said that the recruitment industry is a small world with lots of movement. So between you, you and your team probably have a good pool of past experience. Think back to any recruitment software you used that worked well.

Be careful not to overplay personal preference though. You’re being objective on behalf of the team; you’re not deciding which recruitment software you personally want most.

Your network

Other recruiters’ can be a goldmine. Ask them what they’re using, what they’ve loved and what they’d avoid in the future.

But again, don’t weigh recommendations too heavily. Jack might love Provider A’s ATS, but his company’s business model might be totally different. Or Kacey might’ve had a crap experience with Provider B, but that was one account manager who’s since left the business.

Forums

Don’t just seek recommendations from your personal network. Branch out and look for recommendations from the wider recruitment community, in LinkedIn groups, Facebook groups, and recruitment forums like FIRM.

Give preference to advice from recruiters in similar size businesses, because you’re typically facing the same set of challenges.

Are you an SME looking for something cheap and cheerful, for example, or a bigger business that needs something with advanced configurability?

Industry publications

You’ll often find when researching recruitment software providers, that they’re talked about in industry news. Many businesses guest-post on popular recruitment sites, as well as independent lists like the prestigious Fosway 9-Grid™ and awards. (Talking of awards…)

Step 4: Hone your shortlist

Now the real deep-dive research begins, weighing up your list of providers against your evaluation matrix to build a shortlist. You’ll ultimately want something like three to five shortlist options.

Rule out no-hopers

Depending how specific your software needs, there might be loads of providers on your longlist.

In that case, it’s helpful to do a quick pass to rule out anyone obviously unsuitable. That’ll be providers who definitely don’t offer something you definitely need – but don’t make assumptions. Just because a business doesn’t list a feature on their website doesn’t mean they don’t offer it.

Talk to providers

Now you need to speak to the providers on your longlist. (You don’t need full product demos at this point).

Schedule sales calls so you can complete your evaluation matrix– most providers should have an option through their contact page, or email. Explain you’re currently researching recruitment software providers and want to have an initial chat.

Due diligence

As your shortlist starts to take shape, start looking more deeply at providers’ reputation. Do they have reviews and testimonials? Do they have case studies? Have they had experience working with businesses with similar needs to yours?

Step 5: Gather proposals and demos

Now you’ve narrowed down your shortlist, schedule a full product demo and ask each provider for a proposal.

Ask your manager whether they want to attend product demos live themselves, whether they want other team members to attend, or whether they’d rather you record the sessions.

This is your opportunity to dive into nuance.

Like, Provider A ticks the ‘support’ box – but where’s their support team based? What’s their response time? What’s their average downtime?

And Provider B is super configurable for complex teams – so how would our team do X? How would the system handle Y? What’s the workflow for Z?

At this point, you’ll have completed your entire evaluation matrix and, most likely, have a good idea which recruitment software’s best suited to your team’s needs.

Step 6: Present your findings

Now you have a shortlist of three to five recruitment software providers who tick your boxes, plus proposals and product demo recordings from each.

The last piece of the puzzle is presenting your findings in a clear, compelling way that does your research justice.

You don’t need to go overboard on the detail but confident, trustworthy, balanced analysis shows you’ve done a great job. Presenting your findings in-person is best because you can add nuance, share your impressions and take questions.

In your presentation, include:

- An overview of your method

- A short summary of each provider

- Pros and cons of each provider

- Links to proposals and demo recordings

- Key contacts names and emails

- Your own reasoned recommendation

Step 7: Volunteer to lead next steps

Prove you’re ready for extra responsibility, by going above and beyond to make your manager’s life easier.

Like…

- Proactively return to providers with any follow-up questions.

- If your manager wants to talk to providers themselves, set those calls up and make introductions.

- Once the team’s made a final decision, your manager has to present a business case to the senior leadership team. Offer to help.

- Once the investment’s signed off, offer to liaise with legal and finance to get contracts sorted.

The point is, reduce friction wherever you can. That’s where you can add most value.

Getting new recruitment software is super exciting – especially if you’ve been chafing against the restraints of your old set-up for a while.

But researching software providers can be an intimidating task, and the stakes for the team, your manager and the business are high. Follow this roadmap to prove you’re more than capable of handling the responsibility.

Tribepad are award-winning recruitment software providers. Our software’s used by more than 20-million people worldwide, in industries like retail, hospitality, legal, telecoms, finance, healthcare, agency recruitment, education and the public sector. Book a short call here.